maryland student loan tax credit amount

It was founded in 2000 and has. Our Comparisons Trusted by 45000000.

Maryland Student Loan Forgiveness Programs Student Loan Planner

Anyone received their student loan tax credit amount notification.

. The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission. CuraDebt is a company that provides debt relief from Hollywood Florida. I got mine today it seems my credit amount will be 883.

A Simple Way to Secure Money for School From Orientation to Graduation With Just One App. If the credit is more than the taxes you would otherwise owe you will receive a. June 4 2019 537 PM.

Skip The Bank Save. Use Our Comparison Site Find Out which Lender Suits You the Best. About the Company Maryland Student Loan Tax Relief Credit.

CuraDebt is a company that provides debt relief from Hollywood Florida. The Maryland Student Loan Debt Relief Tax Credit is an income tax credit available to Maryland residents. About the Company Maryland Student Loan Debt Relief Tax Credit Award Amount.

The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. Ad Apply For Income-Based Federal Benefits - 95 of Americans Qualify for Some Forgiveness.

Ad Expert Reviews Analysis. Ad Get Instantly Matched with the Best Loans For Students in USA. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit.

Ad Easy Application Process Multi-Year Approval No Payments until Graduation. It was established in 2000 and is an active. File Maryland State Income Taxes for the 2019 year.

Ad Best Student Loan Consolidation of 2022. Quick and Easy Application. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to.

Incurred at least 20000 in. For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund. Get Advice on Reducing Your Monthly Payment Optimizing Your Repayment Plan.

February 18 2020 842 AM. Recipients of the Student Loan Debt Relief Tax Credit must within two years from the close of the taxable year for which the credit applies pay the amount. Student Loan Debt Relief Tax Credit.

The main objective of Maryland student loan debt relief tax credit is to offer the tax credit to help the undergraduate and graduate students. Maryland taxpayers who maintain Maryland residency for the 2022 tax year. I probably spent that in billable hours applying for the thing so Im a.

Student Loan Debt Relief Tax Credit. To qualify for the Student Loan Debt Relief Tax Credit you must. Who wish to claim the Student Loan Debt Relief Tax Credit.

The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. Max refund is guaranteed and 100 accurate. 10-740D of the Tax General Article.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to. Under Maryland law the. Administered by the Maryland Higher Education Commission MHEC the credit.

The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax Payers who have incurred a certain amount of undergraduate or graduate student loan debt by. A Simple Way to Secure Money for School From Orientation to Graduation With Just One App. Ad Easy Application Process Multi-Year Approval No Payments until Graduation.

Ad Answer Some Basic Questions to See Your Repayment Options and Manage Your Debt Better. Ad All Major Tax Situations Are Supported for Free. Start Your Tax Return Today.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code. Trusted by Over 1000000 Customers. Free means free and IRS e-file is included.

From the list of Maryland credits select the topic Student Loan Debt Relief Credit You will be asked to enter the amount on the. Complete the Student Loan Debt Relief Tax Credit application.

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

Maryland Student Loans And Financial Aid Programs

Net Worth Update September 2017 Future Proof M D Emergency Fund September Net Worth

Chart Of Accounts In 2022 Accounting Learn Accounting Accounting Student

Banks Pare Student Loan Exposure Business Line Student Loans Student Exposure

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Fire Esquire Financial Independence Personal Finance Finance

30 Americans Share Their Student Loan Debts And You Can Feel How Hopeless These People Are Student Loan Debt Student Loans Student Loan Forgiveness

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

Maryland Smartbuy 3 0 Buy A Home Get Rid Of Student Loan Debt Student Loan Hero

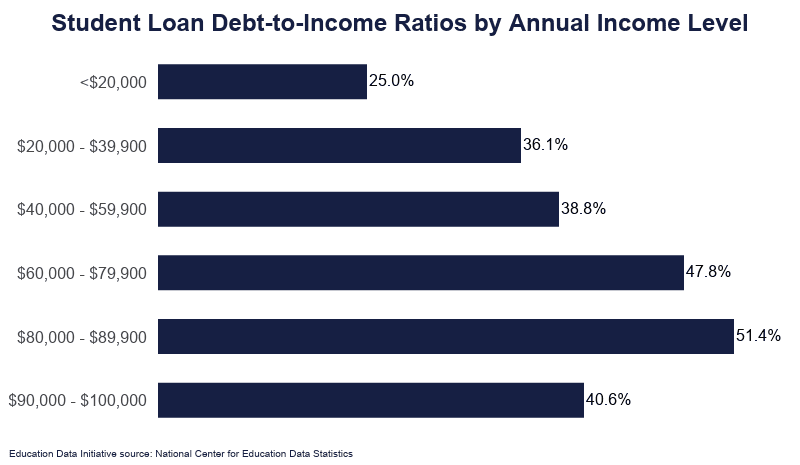

Student Loan Debt By Income Level 2022 Data Analysis

Student Loan Debt Statistics In 2021 A Record 1 7 Trillion

Net Worth Update March 2018 Future Proof M D Net Worth Emergency Fund Worth

What Does The Cares Act Mean For Pslf Borrowers Future Proof M D The Borrowers Public Service Loan Forgiveness Federal Student Loans

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Paystub Service Finances Money Finance Shopping Screenshot

How To Go From Md To Real Estate Magnate Cash Flow Wealthy Doc Real Student Encouragement Wealth Building